GnuCash is an open-source double-entry bookkeeping software. In a series of posts this week, I will describe how I use GnuCash to manage my finances. The series will be biased towards a portfolio composed primarily of Indian mutual funds. This post describes the chart of accounts involved and the purpose of each account.

While a double-entry system may sound like an overkill for personal use, GnuCash provides a relatively intuitive interface for it. For example, it uses more intuitive terms (deposit, withdrawal, buy, sell, etc.) depending on the type of account, instead of the standard “debit” and “credit”. This allows someone without a strong knowledge of accounting to use it with ease.

GnuCash also provides some important advantages over most online portfolio tracking services.

A spreadsheet can provide many of these benefits too. But after the initial learning curve, GnuCash is far easier to use than a complex spreadsheet.

In accounting, accounts are categorized into different types depending on what they represent. GnuCash provides a wide array of account types. Out of those, the following are the most relevant to managing personal finances.

Accounts of this type represent the capital invested. It is called equity, because it represents the share of the owners in business accounting. This has nothing to do with equity as an asset class for investment.

Accounts of this type represent the assets owned by you. The balance in these accounts increase your net worth. These are further classified as:

Accounts of this type represent borrowings and any pending payments. In the context of personal finance, loan accounts will be of this type. The balance in these accounts reduce your net worth.

Accounts of this type represent income generated using assets. In the context of personal finance capital gains and interests will come out of this.

Accounts of this type represent expenses incurred during investment activities. Taxes, transaction fees, home maintenance costs, etc. will go here.

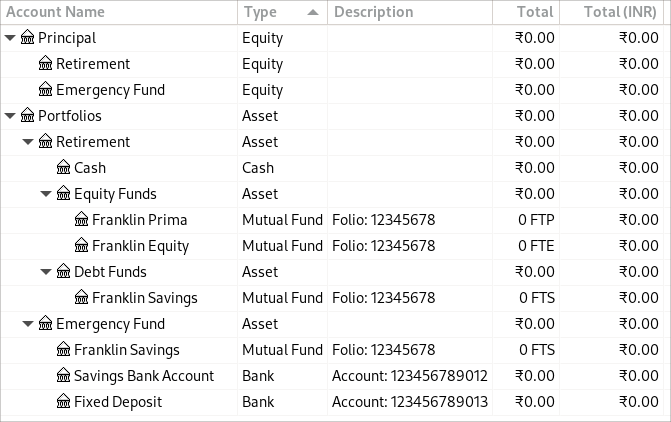

I only track my goal-oriented investments in GnuCash. I do not use it to record my salary and daily expenses. I create an Equity account for each of my financial goals. When I make an investment towards a goal, I use the corresponding Equity account as the source of funds. This also allows me to distinguish between money allocated to goals from my income and money flowing in and out of mutual funds when rebalancing. When I sell assets to achieve a goal, money is returned to the goal’s Equity account.

Asset accounts are similarly grouped by the goal. They are also further classified by the asset class (debt, equity, etc.). This allows me to get an approximation of the current asset allocation for the goal at a glance, as the total value of child accounts is displayed against the parent.

If you borrow to purchase a house as investment, you can track the house as an asset and the home loan as a liability under the same group. You can also track all the expenses incurred to get a precise value of the returns earned.

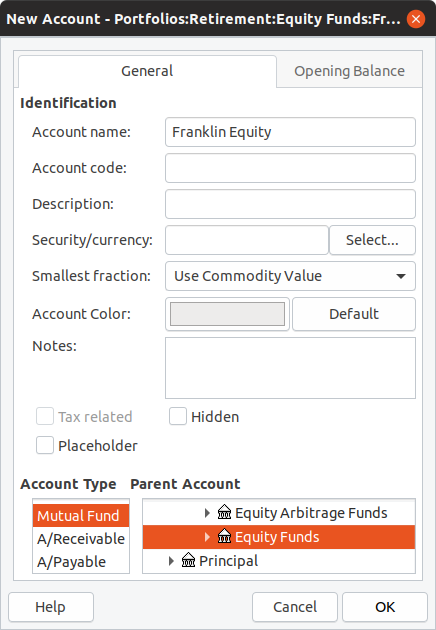

While creating most of the accounts mentioned above is straightforward, creating accounts of type Mutual Fund is slightly more involved. Right-click on the parent account under which you want the mutual fund account to be created and select New Account….

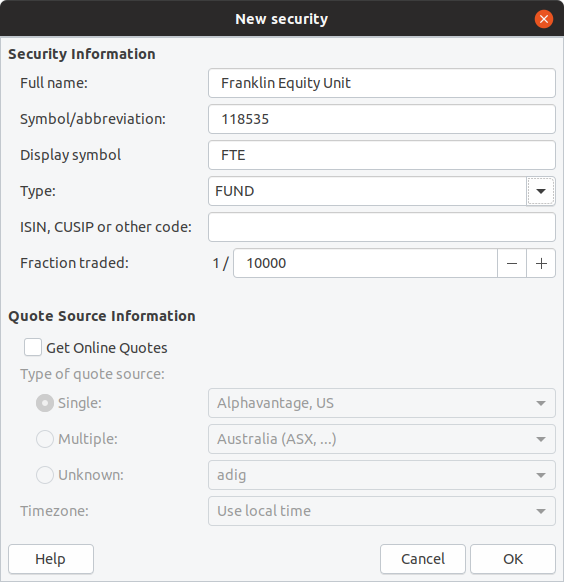

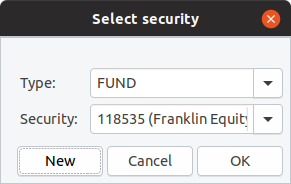

Verify that the newly created account has been selected in the Select security dialog and click OK.

Note: A new security needs to be created only when a new fund is used. When creating a new account with an existing mutual fund, it can be selected from the drop-down in the Select security dialog. All securities can be modified using Security Editor under the Tools menu.

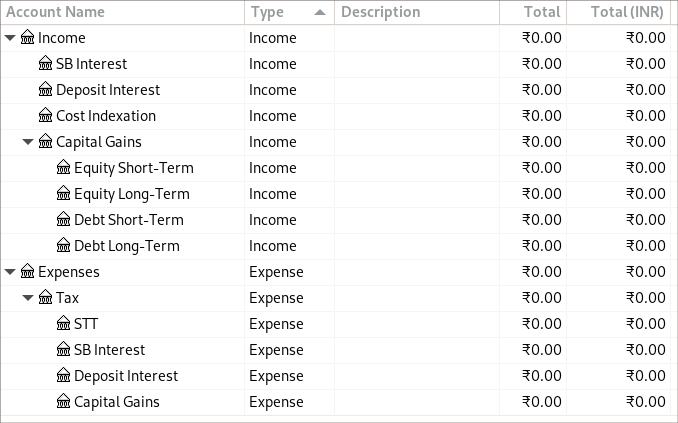

I create separate Income accounts for gains from different account types, asset classes, and duration of holding. This simplifies computation of tax liability and verification of taxes paid, as taxation rules in India differ by asset class, account type (interest earned on fixed deposit and savings bank account are taxed differently), and duration of holding.

A GnuCash file containing the chart of accounts described above can be downloaded and used as a starter template for your own purposes. In the next post, I’ll describe how I record my transactions in the above accounts and manage taxation.

All opinions are my own. Copyright 2005 Chandra Sekar S.